Last updated on March 20th, 2024

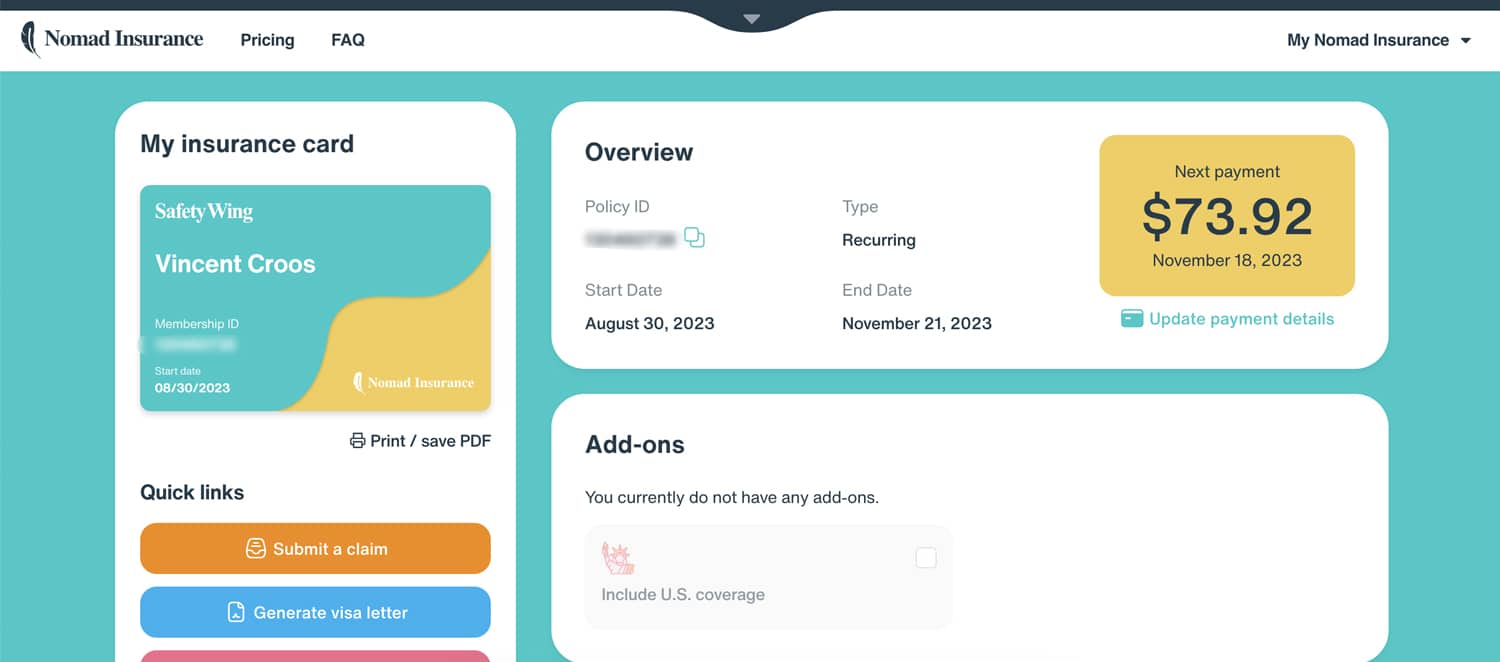

At the time of writing this SafetyWing review, I’m currently covered under SafetyWing’s Nomad Insurance: a travel medical insurance plan.

As the world becomes more globalized, the number of digital nomads, backpackers, and long-term travelers is rising. Consequently, the demand for flexible and comprehensive travel medical insurance has skyrocketed.

One company that has stepped up to the plate to cater to these needs is SafetyWing.

This comprehensive SafetyWing travel insurance review will delve into the history, features, pricing, pros, cons, and customer experiences associated with this travel insurance company.

I’ll also review SafetyWing’s options of Nomad Insurance, Nomad Health, and Remote Health. Yeah, it’s a bit confusing, but I’ll break it down for you.

SafetyWing Review At a Glance

| Overview | Nomad Insurance | Nomad Health | Remote Health |

|---|---|---|---|

| Price | From $56/4 weeks | From $123/month | From $80/month/member |

| Max Benefits | $250,000, $100,00 for ages 65 -69 | $1.5 million | $1.5 million |

| Deductible | $0 | None, 10% co-insurance on outpatient services | None, 10% co-insurance on outpatient services |

| Emergency Dental | 100% covered | 100% covered | 100% covered |

| Preventative Dental | Not covered | 100% covered with add-on up to $1500 | 100% covered with add-on up to $1500 |

| Vision Care | Not Covered | 100% covered with add-on up to $500 | 100% covered with add-on up to $500 |

| Children | One child older than 14 days, but less than 10 years old, per adult, is included for free | Dependent children under 18 years old or under 24 years old and a full-time student are eligible, premium applies | Dependent children under 18 years old or under 24 years old and a full-time student are eligible, premium applies |

Related: World Nomads Review

History of SafetyWing

SafetyWing was founded by Sondre Rasch, a visionary who saw the need for services like travel and health insurance for remote workers and digital nomads. The idea came to Rasch while working on his previous company, Superside. Since its inception, SafetyWing has shown significant growth, boasting $24M in revenue and 25,000 customers as of 2023.

SafetyWing Review: An Overview of the Features, Benefits, and Services

SafetyWing offers three main products: Nomad Insurance, Nomad Health, and Remote Health.

Nomad Insurance

SafetyWing’s Nomad Insurance is a travel medical product providing coverage for people traveling or living abroad. This includes benefits like emergency medical evacuation, trip interruption, and lost checked luggage.

You’re also covered for short visits to your home country every three months abroad.

As of October 25, 2023, Nomad Insurance 2.0 was introduced with the add-ons of adventure sports coverage and electronics theft. Keep in mind that most regular sports don’t require the adventure add-on, including skiing and snowboarding unless you are specifically doing stunts or going off-piste. On the other hand, scuba diving will require the adventure add-on.

The add-ons are currently unavailable to US residents but are expected in the future.

Nomad Health

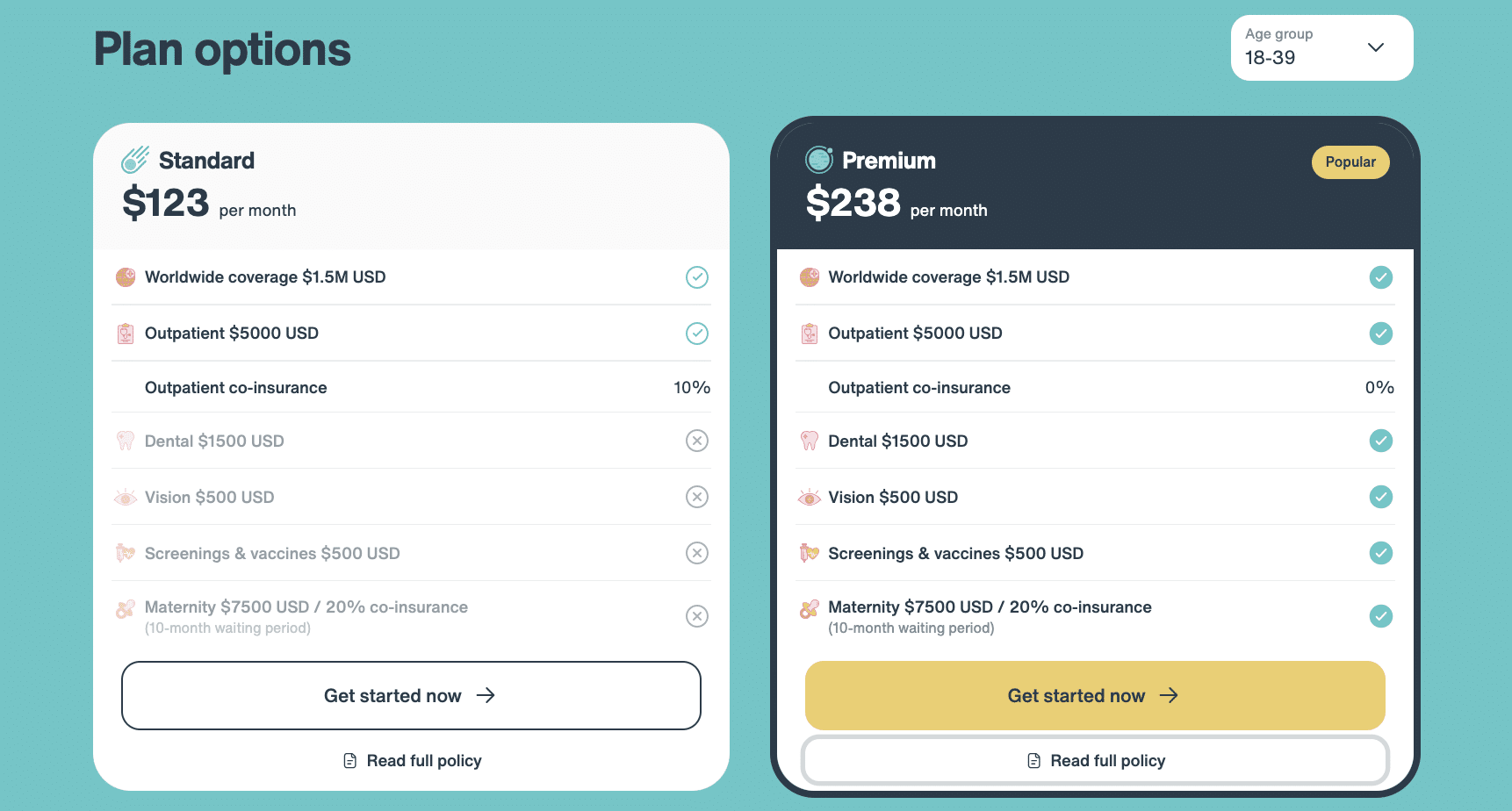

Continuing, SafetyWing’s Nomad Health is a more comprehensive global health insurance designed for remote workers and nomads.

The plan also includes coverage in your home country without the requirement of being abroad for more than three months, like Nomad Insurance. Plus, there is no exclusion of adventure sports or a required add-on. For these reasons, Nomad Health is noticeably more expensive than Nomad Insurance. However, it doesn’t include trip interruption or lost checked luggage coverage.

The premium Nomad Health plan includes preventative dental and vision care benefits. SafetyWing also provides maternity benefits for expecting mothers up to $7500 with 20% co-insurance (a 10-month waiting period applies).

Remote Health

If you’re an entrepreneur operating your own remote company, whether it be a web design, SEO, or consulting agency, then Remote Health is quite appealing. It allows you to provide travel medical insurance to your remote employees, including dental (with a premium add-on).

Providing health coverage to your employees is an excellent way of compensating them and incentivizing employees to work for your remote company, which can also be tax-deductible depending on your tax residency. From an HR compensation perspective, offering health insurance is part of the total compensation benefits package.

SafetyWing Nomad Insurance vs Nomad Health vs Remote Health

Nomad Insurance is a budget-friendly option that covers emergency medical and dental insurance plus non-health travel benefits such as trip interruption.

On the flip side, Nomad Health and Remote Health (coverage for your remote employees) are comprehensive travel medical insurance that also covers preventative care depending on the plan chosen and coverage in your home country. Unlike Nomad Insurance, they do not include non-health travel benefits like lost luggage at the moment.

Exploring the Cost and Pricing of SafetyWing Plans

The pricing for SafetyWing’s Nomad Insurance starts at $45 per four weeks ($83, including coverage in the US), making it an affordable choice for many digital nomads. The cost varies based on the age of the insured.

For more comprehensive coverage, including in your home country, Nomad Health starts at $123 and $238 per month with dental and vision health benefits.

Remote Health starts at $80/month/person. It requires a phone call to be made, so the exact costs are not easy to determine.

How Does SafetyWing Compare to Similar Companies

The travel insurance industry is competitive, and only a few insurance providers cater to long-term travelers, backpackers, and digital nomads. Here are a few companies similar to SafetyWing and some sample costs.

Companies Similar to SafetyWing

What SafetyWing Doesn’t Cover

SafetyWing does not cover routine check-ups, preventive care, cancer treatment, or maternity care under its Nomad Insurance plan. For more comprehensive coverage, consider their Nomad Health plan.

Pros and Cons of SafetyWing for Travel Insurance

Based on researching customer feedback and my my own experience, SafetyWing offers both advantages and disadvantages as a travel insurance provider.

Pros:

- Affordability: SafetyWing is often cited as one of the most affordable travel insurance options, especially for long-term travel.

- COVID-19 Coverage: SafetyWing offers coverage for COVID-19, a significant advantage in the current global health climate.

- Ease of Purchase: Signing up and purchasing SafetyWing insurance is effortless, even if you’re already on your trip.

- Instant Coverage: Unlike some insurance providers that only start coverage a few days after purchase, SafetyWing offers instant coverage.

- Flexibility: Flexible travel medical insurance options between Nomad Insurance and Nomad Health.

- Customer Support: Travelers have praised the company for its excellent customer support.

Cons:

- High Deductible: One disadvantage of SafetyWing is its high $250 deductible for US residents on its cheapest plan, Nomad Insurance.

- Limited Gear Coverage: The company offers limited coverage for adventure sports with Nomad Insurance but has an adventure sports add-on.

- Service Issues: Some users have expressed dissatisfaction with the service, stating difficulties in reimbursing healthcare costs incurred abroad.

It’s important to note that individual experiences with SafetyWing can vary, and the information above is a summary of various sources, research, and our own experience.

How SafetyWing Makes Traveling Easier and Safer

SafetyWing makes traveling more accessible by providing a safety net for unforeseen medical emergencies.

Their 24/7 customer support ensures help is always available, and their global coverage gives peace of mind to travelers.

The fact that you can buy travel medical insurance while already traveling is a clear advantage over national-only travel insurance plans.

Furthermore, the low-cost SafetyWing Nomad Insurance plan includes free travel medical insurance for one child per adult up to 10 years old. How many travel medical insurance plans dedicated to remote workers and digital nomads offer this benefit to parents?

And then, you have the option of adding value to your travel insurance with Nomad Health, where you can purchase the premium plan, which includes preventative care for dental and vision, plus maternity benefits.

Other benefits SafetyWing Offers

Borderless: SafetyWing’s dedication to travelers provides essential information for long-term travel, living abroad, and making life as a digital nomad as easy as possible. Want to live and work in Amsterdam, Bali, or Chiang Mai? Then check out their guide.

By the way, you see what I did there: ABC. If you’re well-traveled, or almost, you already know that ABC is also the Dutch ABC Islands of Aruba, Bonaire, and Curacao. Now you have to go there, right?

Perks: Forget Airbnb. A growing collection of benefits for SafetyWing members from Argentina to the United States, including discounts on co-working and co-living spaces.

Building Remotely: A brilliant podcast that takes you on a journey into remote work and entrepreneurship.

A Step-by-Step Guide on How to Get Started with SafetyWing

- Visit the SafetyWing website.

- Choose between Nomad Insurance and Nomad Health.

- Fill in the required details.

- Choose your start date and end date (if applicable).

- Review your coverage and price.

- Complete the payment process.

Tips for Getting the Most Out of Your SafetyWing Membership

To save money, you should compare SafetyWing vs World Nomads. The main reason: World Nomads can sometimes be cheaper depending on the countries you visit. However, for example, it costs more for Canadians to travel to Sri Lanka and be covered with World Nomads than SafetyWing Nomad Insurance.

So, it’s always a good idea to do a cost analysis.

Also, check your employer-sponsored health benefits if they cover extended travel or working remotely abroad.

Furthermore, premium credit cards often offer travel insurance, including emergency medical and trip interruption for the first 14 days. The coverage can oftentimes be extended. So, you’ll have to check with your credit card’s underwriter and see what the cost of extending the coverage is; it may be cheaper than SafetyWing.

You can set your start date for your SafetyWing insurance after your credit card’s travel insurance expires, saving you 14 days’ worth of premiums.

What Do Customers Say About Their Experiences with SafetyWing

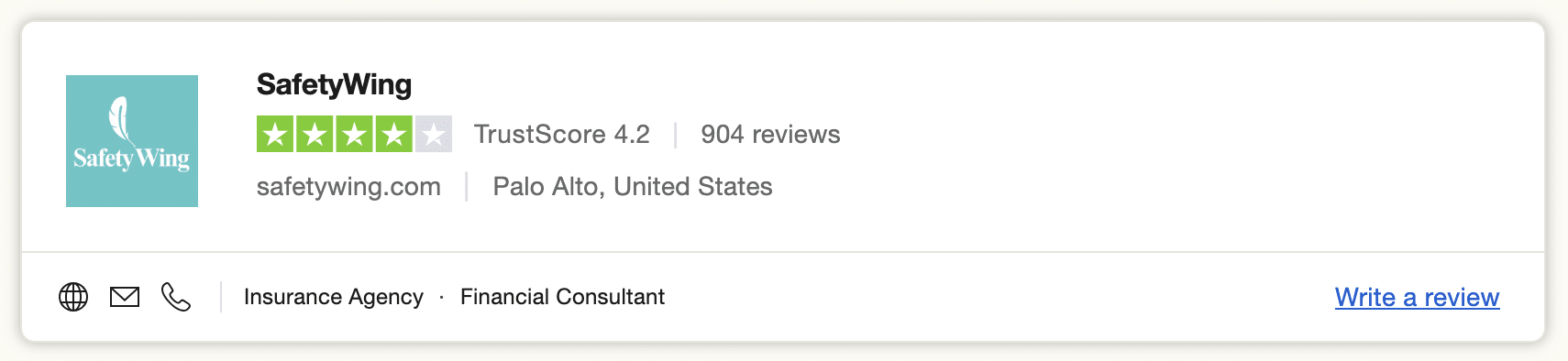

Customer feedback about SafetyWing is mixed. Some customers have praised SafetyWing’s cost-effectiveness and convenience, while others have criticized the claims process. However, with SafetyWing Nomad Insurance 2.0, the company is aiming to turn around claims in seven to ten business days.

On Trustpilot, SafetyWing has a pretty decent score of 4.2 out of 5, with over 900 reviews. To put this into perspective, World Nomads, one of the major competitors in the travel insurance industry, has a rating of 3.5.

SafetyWing has managed to reply to 92% of negative reviews, often within two weeks. This shows their dedication to customer service and their commitment to addressing concerns promptly.

A review analysis from various pages on Trustpilot revealed that SafetyWing has been described as “great” by many users.

The company’s proactive approach to responding both to positive and negative reviews indicates its eagerness to improve its services and meet customer expectations.

And regarding how fast SafetyWing pays out claims, a customer by the name of Michaila gave 5 stars on Trustpilot on October 24, 2023, stating, “Fast Processing: Superb processing of claims. Very convenient, easy, and fast.”

The Final Word: Should You Choose SafetyWing For Your International Health Insurance Needs

SafetyWing offers an attractive package for digital nomads, backpackers, and long-term travelers seeking affordable, flexible, and comprehensive travel insurance.

In my opinion, if you’re a budget traveler or backpacker, opt for Nomad Insurance. If you’re a digital nomad traveling with expensive equipment, opt for Nomad Insurance with the equipment add-on.

On the other hand, if you travel frugally, other travel insurance plans may be cheaper. So, check out World Nomads, Genki, and national plans in your home country.

Frequently Asked Questions

How to file a claim with SafetyWing

Filing a claim with SafetyWing is relatively easy, and you can also do it on your Android or iPhone web browser. Here are the steps you need to follow:

1. Submit the Claim Form and Documents

The first step in the claim process is to submit your claim form along with all necessary documents.

If you are filing a medical claim, make sure to attach the following:

(a) Your medical report: This should be a note from your doctor that includes your symptoms, diagnosis, and treatment. (b) A detailed invoice: This should outline what you paid for. (c) Proof of payment or receipt: This proves that you have made the payment.

Don’t forget to provide the policy number under which you are making the claim. You can find this in your receipts tab, where all your previous policies are listed.

2. Receive Confirmation

After submitting your claim and necessary documents, you will receive a confirmation email. The email serves as an acknowledgment that your claim has been received and is being processed.

3. Track Your Claim

Processing your claim typically takes less than 15 business days. You can keep track of this process through WorldTrips’ Member Portal. For instructions on how to do this, click here.

4. Get Reimbursed

Once your claim is approved, you will receive your reimbursement directly into your bank account through a wire transfer. Please note that the timing for this can vary depending on your bank’s processing times.

Note: All claims must be submitted within 60 days of the plan termination date for Nomad Insurance and within 180 days of the service date for Nomad Health. Please read your policy for the most up-to-date information.

Does SafetyWing cover pregnancy and maternity?

Yes, depending on the plan you select.

SafetyWing Nomad Insurance covers complications during the first 26 weeks of pregnancy up to the plan limit, excluding pre-existing conditions or where travel is not recommended by a licensed physician. There are no maternity benefits with Nomad Insurance.

SafetyWing Nomad Health Premium covers medically necessary pregnancy and maternity healthcare, including pre and post-natal checkups within 30 days of discharge, up to a maximum of $7,500 with a 20% co-insurance.

Does SafetyWing cover motorcycle and scooter accidents?

SafetyWing does cover you for emergency medical as a result of a motorcycle or scooter accident. However, you have to be properly licensed in the jurisdiction you are visiting and wear a helmet.

Also, ensure you don’t use unlicensed motorcycles for a taxi ride. If you sustain injuries, you most likely will not be covered. Use an official taxi or Uber.